In my opinion, that fact was the highlight of this year's American Society of Clinical Oncology (ASCO) meeting. Additional long term data collected from treated patients since that time has further demonstrated that Oncophage works, according to reports released earlier this year.Īlso of note, once regulators and medical professionals began using patient survivability instead of tumor progression as a marker of success for cancer vaccines, it was hard to ignore the fact that extending the lives of patients is exactly what these vaccines were capable of doing. Oncophage did not meet the standards for a US approval in a previously conducted Phase III trial, but Russia granted approval based on a subset of patients that responded well to the treatment. Once Provenge is granted approval in the United States, I would expect to see a rally in the other cancer immunotherapy stocks, such as AGEN, ONTY and CVM.Īntigenics NASDAQ:AGEN) is preparing to launch the kidney cancer vaccine Oncophage in Russia in the fourth quarter of 2009 and is also awaiting a marketing approval decision by the EMEA in Europe.

However, IF the FDA does approve the treatment, which I consider likely, and the New Jersey manufacturing facility is fully ramped up by the timeframe outlined in Thursday's press release, then I can see DNDN becoming a hundred dollar stock a couple of years down the road, barring a stock split or a buyout. There's a lot of "ifs" still left to sort out - the most important being that none of this occurs IF the FDA does not approve Provenge. From that point on, after a few quarters of Provenge sales, when we should have a good feel for just how much revenue is coming in, the stock could still move up very significantly - especially if Neuvenge looks to also be posting positive Phase II and III results by then. Assuming both that Provenge receives FDA approval and that the company's sales estimates are fairly accurate, I would expect fifty dollars a share to be attainable by the end of 2010. With a current market cap of over three billion dollars, DNDN is pretty much priced for possible approval, however I would expect to see the stock trading for over thirty dollars by the time the FDA issues a decision next year. When it's all said and done, there is a whole lot of potential still wrapped up in this company and its stock. Neuvenge can potentially treat multiple cancers, including breast, bladder and colorectal. The company also has Neuvenge in its back pocket. Provenge is not the only product that Dendreon has to offer. I was also reported in the press release that additional manufacturing facilities will be opened in late 2011 in Los Angeles and Atlanta.īefore we look at the potential of the DNDN stock, let us also consider the potential of the pipeline.

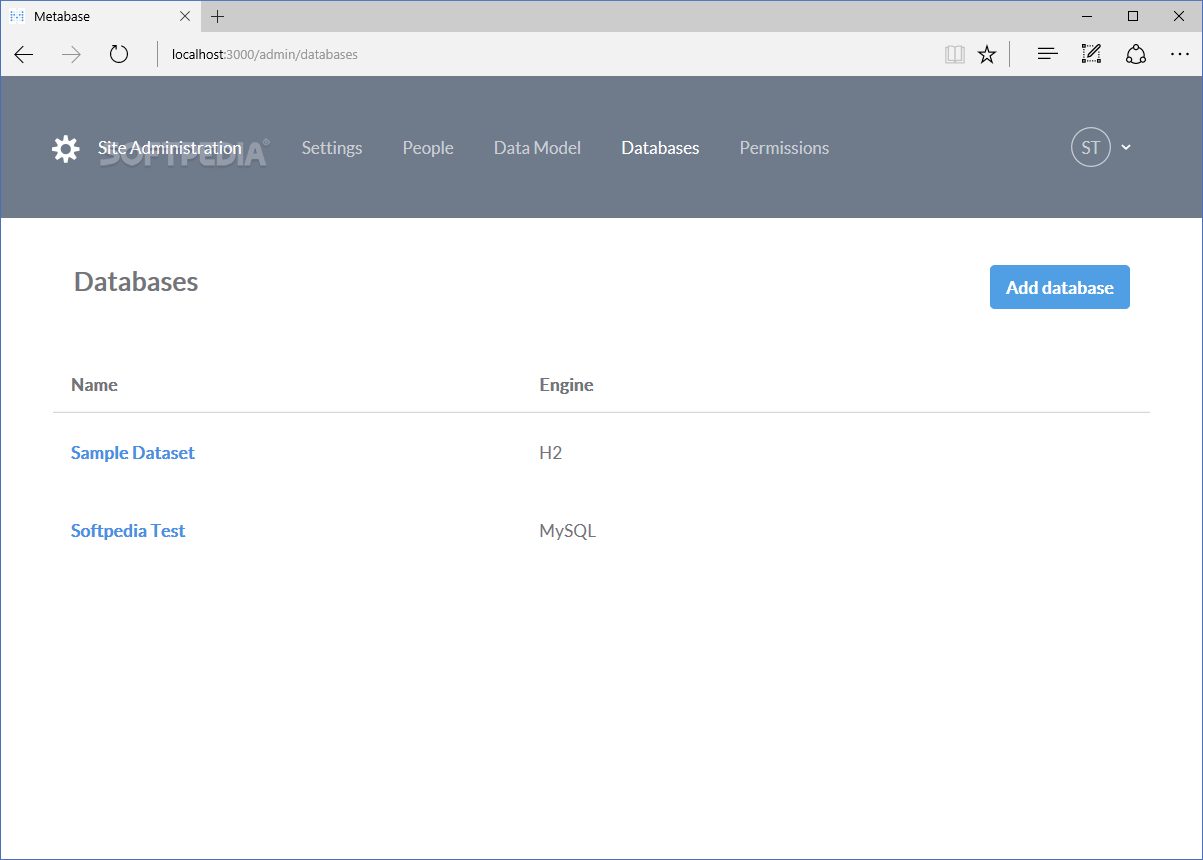

Metabase 30m series insight full#

For full year 2011, the estimates were for well over one billion dollars as the manufacturing plant in New Jersey would by then have the capacity to produce the product at a level to support that much in sales.

It was Oncophage, a kidney cancer vaccine produced by Antigenics, that became the world's first approved cancer immunotherapy when the Russian medical authorities approved it in April of 2008.Īs for Thursday's DNDN press release, the company issued Provenge sales estimates of between $60 and $120 million for the second half of 2010. I like the chances of a Provenge approval, although I think that by the time the treatment becomes approved in the United States, it will be long overdue. That being said, as long term data continues to demonstrate that the treatments work, they are slowly becoming more accepted by the medical field and Provenge is no exception. While indications point to an FDA approval, it is also good to realistically temper the enthusiasm by remembering that members of the FDA are humans - government officials, at that - and are just as likely to change their minds or ask for more information as anyone else out there. Keep in mind, however, that nothing is a sure thing both in regards to the stock market or the FDA. It is expected that the FDA will rule to approve Provenge, based on previous comments by the regulatory agency after mid term results were released last year.

The company announced that they will file an NDA with the FDA in November and that the FDA would then be expected to act on the application by mid 2010.

Metabase 30m series insight update#

That's good news for investors who have long been interested in this promising sub-sector of the healthcare markets.ĭendreon (NASDAQ:DNDN) released an update on Thursday that outlined the path that the company is taking to advance its prostate cancer treatment Provenge to market. Cancer immunotherapy stocks are back and may be making a strong push.

0 kommentar(er)

0 kommentar(er)